1. Introduction & Background

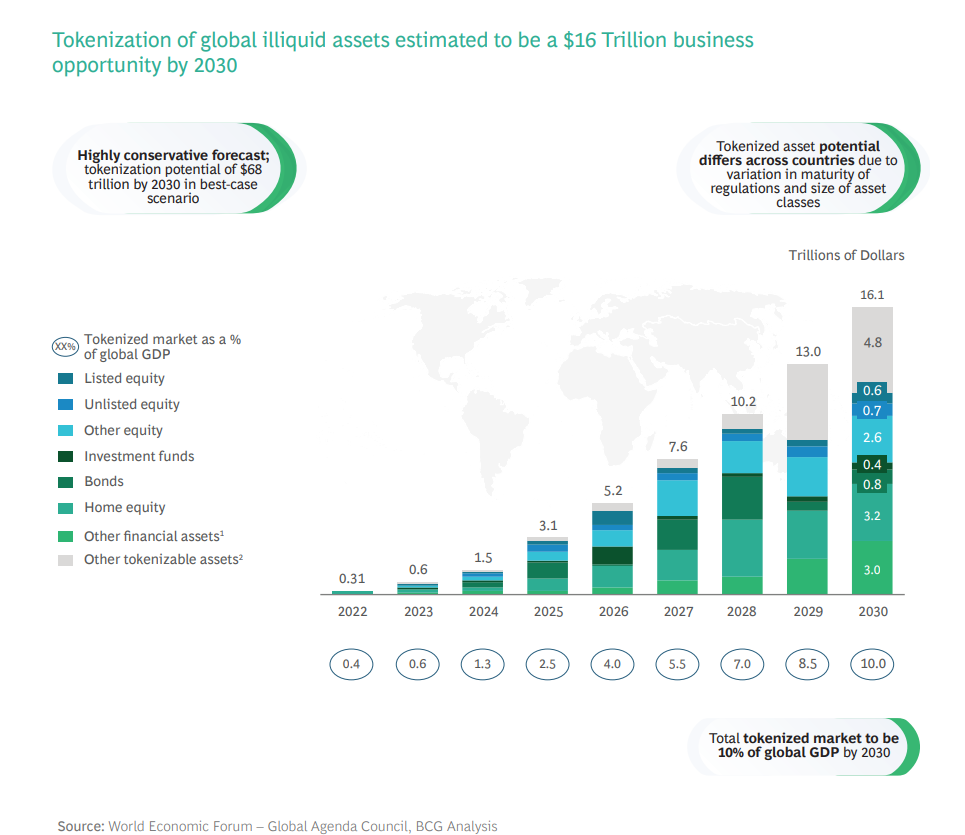

The total value of global real estate, art, commodities and other real world assets is estimated to be over $2 trillion. However, access to investing in and trading these assets has traditionally been limited to high net worth individuals and large institutional investors. Crypto technology is now making it possible to “tokenize” ownership of real world assets, breaking them down into digital tokens that can be traded more accessibly on blockchain networks. This process of asset tokenization represents a trillion dollar opportunity for the cryptocurrency industry to expand into new markets.

According to Savills, the global real estate market alone is worth over $217 trillion according to Savills.

2. Strong Partnerships

Joltify has formed strategic partnerships with top legal firms to fully unlock this market potential through asset tokenization.

Joltify has partnered with Manatt, Phelps & Phillips, LLP, a leading US law firm with over 450 attorneys focused on emerging technologies within financial services. Manatt brings its expertise in fintech and digital transformation to represent Joltify and other clients working on the industry’s frontier.

To expand its reach globally, Joltify has also partnered with AlignLaw, a prominent Australian law firm with experience advising on billion-dollar property redevelopment deals. AlignLaw advised on the $700 million redevelopment of Australia’s largest shopping center, involving major tenant relocations and new constructions on site. The firm has transacted over $35 million property portfolio sales as well.

By working with legal powerhouses like Manatt and AlignLaw, Joltify is ensuring all asset tokenizeion activities fully comply with regulations internationally. It is also opening the door for top-tier real estate projects and companies to utilize the Joltify platform. These efforts through strategic partnerships with industry-leading legal advisors bring massive potential to boost real asset tokenization volumes on Joltify’s network around the world.

3. Tokenization on Joltify

Asset tokenization on Joltify works by issuing digital tokens on the blockchain that represent various interests in real-world assets and financial instruments. Ownership tokens grant fractional ownership of physical assets like real estate and collector’s items. Lending tokens allow individuals to fund personal or business loans in a securitized manner.

Each tokenized asset or loan instrument is broken down into fungible tokens, with each token backed 1:1 by its share of the underlying value. This fractionalization process divides assets and loans into much smaller portions, dramatically increasing their liquidity compared to minimum investment limits of traditional markets. It empowers individuals globally to invest from as little as the value of a single token.

Tokenization also brings unprecedented speed and efficiency to transactions. Ownership and lending tokens can change hands instantly through smart contract execution on the Joltify blockchain. This removes slow and costly third party intermediaries from the process of buying, selling, and transferring assets. Tokens are traded peer-to-peer on Joltify’s decentralized exchange without the friction of legacy systems. Overall, asset tokenization streamlines investing in real estate, art, loans and more like never before.

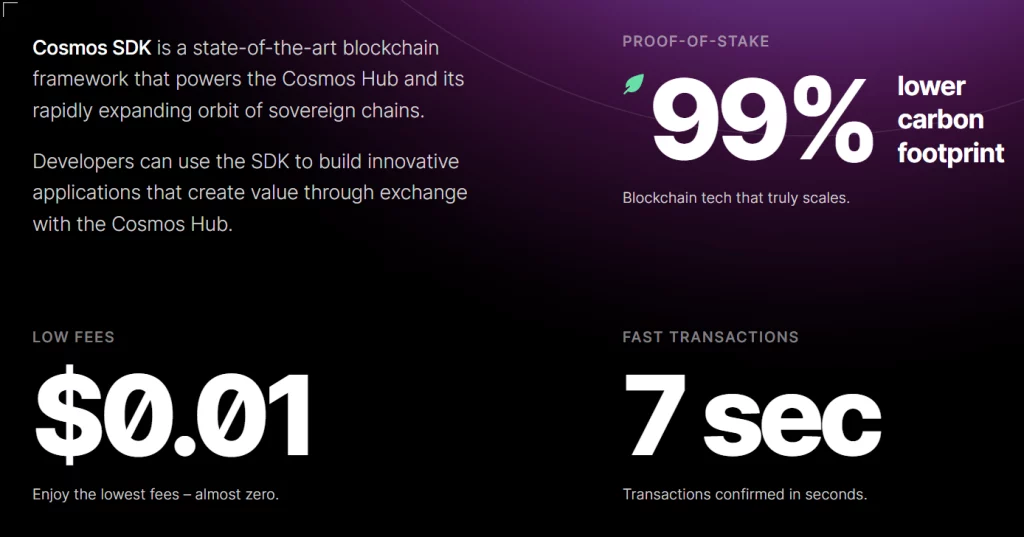

As one of the first public blockchain networks, Joltify is specifically designed for real world asset tokenization. Moreover, Joltify is an Ethereum-compatible Layer 1 protocol build on Cosmos SDK that focuses on providing the necessary infrastructure and tools to tokenize, manage and trade a wide range of real assets on-chain.

Some key benefits Joltify offers for asset tokenization include:

-Extremely high transaction throughput of around 10,000 TPS capable of handling large-scale asset markets.

-Ultra-low transaction fees of just pennies compared to high costs on Ethereum.

-Advanced asset management framework allows for things like dividend distributions, voting rights, regulatory compliance and more.

-DEX built specifically for trading tokenized assets with an intuitive interface.

Unlike Ethereum, Joltify was built from the ground up using updated technology to support up to 10,000 TPS, making it infinitely scalable for large asset markets. Despite 10X more capacity, average gas fees in the RWA are just $0 – unlocking opportunities that weren’t feasible on other chains.

4. Conclusion

Private equity and hedge funds manage over $9 trillion in assets, but have very high minimum investment levels. By making previously illiquid assets fungible and portable in the form of blockchain tokens, Joltify and other platforms enabling real world asset tokenization have the potential to radically transform global markets. It represents the next trillion dollar opportunity for cryptocurrency to penetrate into new sectors and bring unprecedented liquidity to real assets. 2023 could be the breakout year where we start to see large scale tokenized asset markets emerge on protocols like Joltify.